Netflix is said to be paying upwards of US$15 Billion for original content (content they create and content they license).

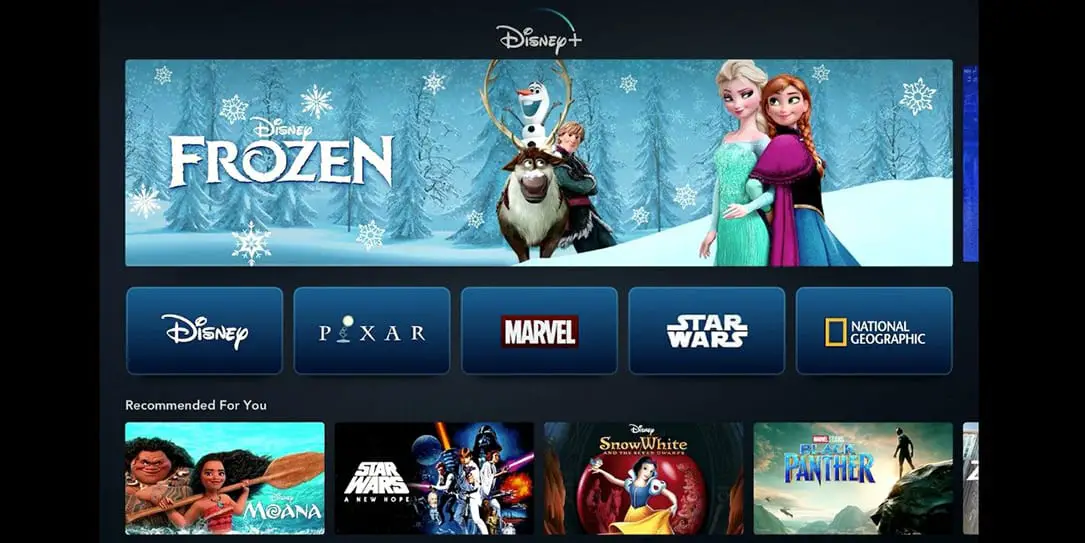

This new move by Disney to offer up a bundle of Disney+/HULU (w/ads)/ESPN+ for US$12.99 is designed to specifically hurt Netflix. On the one hand, it makes it so Netflix will have a really hard time implementing rate increases going forward.

I think it has about one more rate hike in it, at US$14.99/month, to match HBO add-ons (Netflix just recently eclipsed HBO on subscribers), but after that, the jury is out on whether people will still be inclined to pay that premium subscription rate for the content that will be available.

As has been reported over and over, the new AT&T/Warner HBOMax will be taking back Friends, while the forthcoming NBCUniversal streaming service will be taking back The Office from Netflix, both of which are the highest watched content for them. That leaves Netflix scrambling for content, and this is where the real issues arise.

Netflix is said to be paying upwards of US$15 billion for original content (content they create and content they license). At somewhere around US$12.3 billion in debt, and not having paid it down in any significant amount, just when does the money run out? When will investors start seeing visions of MoviePass dancing in their heads? Running on debt can’t last forever.

Also coming to light is Netflix’s new tactic of canceling popular shows. Contracts structured with actors and crews come in at around 2 years. So if Netflix has a popular show, at the two-year mark they have to renegotiate salaries. The cast of the show will want raises and Netflix doesn’t seem to think they are worth it. After all, if a show is already into season 2 and the popularity isn’t leading to substantial subscriber increases, then Netflix views that as a dead end.

It doesn’t matter if the show is popular with current subscribers, because by the numbers they are already subscribed. Then it is just a calculation of subscriber loss due to the cancellation vs how much they would have had to pay out in contract extensions. For Netflix, they seem to be willing to brave a small loss over the one show.

I don’t really see any clear way forward for Netflix at this point. The debt is too much, the subscriber growth will reach a plateau, if it hasn’t already, and the overwhelming content of the other studios, with their decades-old libraries, are next to insurmountable for what Netflix has in this fight. I can see them trying the smart course of action, which is only really a bandaid.

That would be reigning in spending, cutting high production content, focusing on stand up comedy and cheap sitcoms (hope you get a hit), and licensing even more foreign films and TV shows. I don’t think the US TV viewers will like this very much, and they will sustain heavy subscriber loss, but they may be able to last a bit longer this way.

I love Netflix just as much as the next person. Most of the current shows I watch are on Netflix. However, it’s pretty hard not to ignore the dire straits they are in. This is the way of things in technology and media. Netflix found a niche, expanded on it, became king of it, and then those around them got smart and said, “Hey, we can do this too. Why do we need you?” Netflix may very well be the online version of the MoviePass fall, just waiting in the wings. Only time will tell.